Cartoon HD Apk for Android, Windows, and IOS (Latest Version)

Contents

Cartoon HD APK Download

As tech trends are growing day by day, the use of Android smartphones is one of the best ways to get entertained and have a fun time. The best part about using smartphones is that there are a plethora of things you can get on your figure tips. With that being said, with the use of an app like Cartoon HD app, you can easily watch your favorite movies and TV shows in the world.

Now, before we move towards the Cartoon HD app, let’s have a look at what is Cartoon HD APK?

Cartoon HD apk 2023 is a free open-source application that provides you with a seamless experience of watching your favorite TV shows, and movies to get you entertained. That’s not it – To even make your experience better, you can also enjoy improved video streaming with the use of this popular Cartoon HD apk For pc.

As the market for Android devices is almost getting hyped, it can be right to say that it has made the revolution to the smartphone platforms. Yes, it is growing at a rapid pace that can handle the Cartoon HD app and its features and functionality with the advanced technology that users can find it easy to access.

Simply let us put it this way! Who could have ever imagined that you can watch your favorite channels live on your smartphone?

In the year 2023, there is a cluster of Android and iOS smartphone devices that allow you to watch your most likable shows, movie box app, Lucky patcher Apk, Teatv, & Spotify Premium App. on your smartphones.

You can have a free online movie-watching experience, then Cartoon HD is the best movie streaming app that will let you enjoy watching movies, TV Serials, Cartoons, etc without any cost.

So, if you are crazy about watching movies and are addicted to some TV shows but you don’t want to go for paid streaming apps then this is the right place you have come to!

Cartoon HD APK

Among several apps, there is one app called “Cartoon HD APK”, or you can call it “Cartoon HD App.” Unfortunately, when you google the search term cartoon HD apk download for android, then you cannot see the Google Play site in the results.

We are going to give you complete information on how, why, when, where cartoon HD apk download and it’s also free and user-friendly available.

There isn’t much information about the application and its service online, which leads to many people downloading it and finding out the positive and negative points the hard way.

The Cartoon HD App is being used by many people all around the globe. It doesn’t matter if you’re shopping, driving, or in any public place and your kid or baby is not cooperating or misbehaving. Maybe all they want to do is watch cartoons. You can just slide out your phone and play their favorite cartoon, the best way to keep them calm, eh?

It is not just for kids, you too can enjoy watching the top IMDB movies from the collections and other TV series! So, it’s the ease of the app that is helping its way to be one of the best Cartoon streaming apps.

The app comes in different formats for the four different operating systems, i.e, Android, iOS, Blackberry OS, and Kindle Fire OS. However, the app has been taken down from the Google Play Store, and from all other app stores. It is also removed from its official website.

Cartoon HD is a great app to stream Movies Online. It’s not like other Streaming apps that stream Movies, Tv Serials after subscription. Its content is absolutely free.

Whether you love Action, Drama, Comedy or Sci Fiction Movies, etc. You don’t have to get worried in search of a special Genere Movie.

This App provides you a bunch of Genres so that you can get all types of Movies on the same Application.

But don’t worry, here we have the APK file for all operating systems to help you enjoy this App.

What is Cartoon HD App Download?

Cartoon HD is an Android and iOS smartphone application, which allows you to access thousands of your favorite Anime and Cartoon from the modern to the old days.

You need an active Internet connection that enables it to access its servers which give you access to thousands of episodes of your favorite anime, and also you watch the whole series online without any interruption.

We have mentioned Anime, which is a Japanese word. Anime called when designed and made in Japan.

The number of Anime is extremely less when you compare it to the cartoons.

A cartoon is called when it designed and made outside of Japan or especially Written & Designed in the USA.

You may not be able to find any Anime on the platform because the app does not have a list of Anime.

You will be able to watch popular cartoons like Justice League Unlimited to Batman Beyond.

How Does Cartoon HD For Android Works?

As we have already said that it is an Android and iOS app, which requires your smartphone to have at least a 3G connection or above to use it.

When you launch the app, you will have a huge list of shows of cartoon HD apk download for the android latest version, which you have to select. Once you have a tap on any of the episodes, you will be able to watch it.

The app connects to its server, and you will be able to watch the stream using the application.

The whole concept is similar to Netflix, where you can watch some episodes and the whole series. However, there are only two differences in it.

- You don’t have to pay a single penny to use. Everything you browse in the app is absolutely for free-of-cost.

- Coming to content on the app is strictly cartoon, you cannot watch any other content except Cartoon. The app developer has used Tom & Jerry’s picture as the thumbnail because it is strictly a Cartoon based app.

You cannot access the features and functions unless you have installed the app on your smartphone.

The smartphone is one of the most common gadgets nowadays everyone has and most of them are Android because of its Specialized User Interface.

Google Play Store has nearly more than 3.3 Million Apps but the sad news is that this app is not available in the Google Play Store.

It’s a lit difficult to download directly from the Google Play Store but we are going to make it easy You can Download this App from Here

How To Install Cartoon HD App Apk on Laptop

To install and run cartoon HD on your laptop device, then you will have to take care of the below-guided things to successfully run the cartoon HD app on laptop and pc devices.

Cartoon HD for pc free download which is a possible factor but we are going to tell you how you can install it on your Windows PC.

To run cartoon HD apk on your PC, you need to fill certain requirements; then you will be able to run it on your Windows-based PC without any hassle.

Method 1

- You have downloaded a software called “Android Emulator,” which is also known as a simulator that is equivalent to a virtual machine that can run Android apps. Almost 90% of the technology bloggers suggest you download Bluestacks, but I recommend you download Nox App Player, Spotifyfm, which is a recommended Android app player.

- Your PC must have 2GB of physical RAM – It can be DDR2 or DDR3, it does not matter.

- Old graphics cards like Intel 82945G Chipset Family does not support Android emulators because they are not manufactured to take on a task like this one. You can update your graphics driver and try again or else it won’t work. If you are running AMD-processor, then ensure that it supports Hyper-V or else you better skip the idea of installing it on your PC.

- Any motherboards manufactured below 2010 are not supported by this method because Virtualization not supported but these boards.

Method 2

-

First, you need to download an Android Emulator which is basically a virtual machine to run Android apps. Either you can download Bluestacks or there are other easy to use Android emulators like Nox App Player, and Spotifyfm (Android App Player)

-

It requires a minimum of 2GB of RAM – doesn’t matter if it’s DDR2/DDR3.

-

Make sure that your Laptop system has new graphics drivers with the latest updates. Make sure Hyper-V is supported in case you are running AMD-processor – Only then it will be able to run successfully.

-

Check that the Motherboards are manufactured after 2010 as the previous year’s motherboard is not supported.

Download Nox App Player.

All you have to do is to drag and drop the Cartoon HD app on the emulator.

Sometimes a big screen has the best thrilling. So, enjoy your Favorite Movies as well as Television shows on your Computer/Laptop by Using Android Emulators on your PC, whether it’s Mac or Windows.

I have discussed in a precise manner How to Download CartoonHD App on your PC and Install it with Third-party software in Cartoon HD for PC articles. Just read this article to enjoy your Favorite Movies and Television Shows on Big screen.

For the BlackBerry users

Initially download the Cartoon HD document from the connection given on your BlackBerry 10 telephone or Tablet. This process works for the BlackBerry devices running OS version 10.2 or higher, including the Z10, Z30, Q5, Q10, 9982, 9983, Passport, and later.

Now, go to the Settings / App Manager / Install Apps and enable Installing apps from other sources.

Now go back to the downloaded file on your device, open it, and install Cartoon HD. And that is it, you are now set to enjoy the Cartoon HD services.

For the Kindle Fire users

You will also have to install the app through a sideloading process. To install, you don’t need any kind of root access. It’s a simple process it will work for all Kindle Versions. Fire tablet or telephone including the first-gen, HD, HDX, Fire tablets, and the Amazon Fire Phone.

To begin with, you should download the Cartoon HD application record from the connection gave. At that point, on your Kindle Fire or Kindle Fire HD gadget, go to the Settings/Devices/and empower Installation of Apps from Unknown Sources.

For the Kindle Fire HDX, Fire Tablet, and Amazon Fire Phone go to Settings / Security / and enable Apps from unknown sources.

When the above procedure is done, explore back to the downloaded document, open it and snap on Install. That is it, you are now all set to use the app.

The Cartoon HD App is one of the all-inclusive applications accessible for every one of the stages. Other than that, you have numerous different choices, for example, Mobdro and Popcorn Time to stream your preferred motion pictures and TV arrangement.

How to Install Cartoon HD Apk for Android?

We think it would be unfair for those who are using the Android smartphone for the first time will be satisfied.

If you know how to install the cartoon HD apk android app on your smartphone, then skip to the next paragraph because this part is for those who don’t know to download and Install the cartoon HD apk download for the android latest version.

| NAME OF THE APP | CARTOON HD APK |

|---|---|

| Latest Release | 3.0.5 |

| Latest Version Launch Date | Jun 29, 2017 |

| Compatible Version | Android 2.2 to Android 8.0 |

| Size | 3.31 MB |

| Require Rooting? | No |

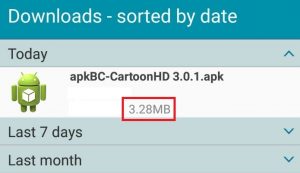

1 – First, download the Cartoon HD App on your smartphone.

2 – Go to the download page and look for the APK file.

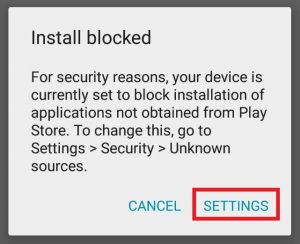

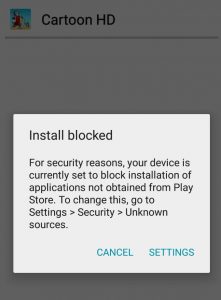

3 – Tap on the file to open it. And there will be a pop-up on your screen, and you have a tap on the Settings.

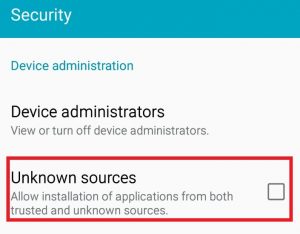

4 – You will reach Security settings, and you have to tap into the “Unknown sources” and proceed.

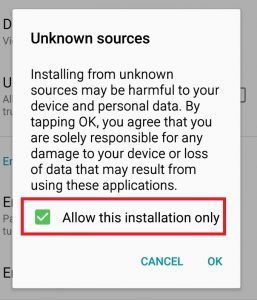

5 – You have to make sure that it is only available for this installation only. In case, if this option is not available, then you have to turn it off manually by going to security > Unknown sources. Just untick it, and you will be able to prevent any other apps from installing.

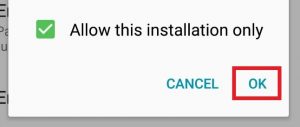

6 – Once done, then click on “Ok” to proceed.

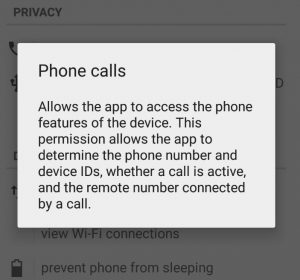

7 – As always Android tells you what access does the app has to your smartphone after the installation. You can see that it has too many of the services that also include the one to come under privacy.

8 – First, it has access to your phone directory and it known when you are making calls and everything, which is weird access they are asking for your permission.

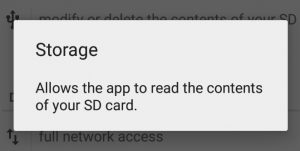

9 – The app has access to your storage, where it can read all of the contents inside of it. We cannot see any reason for the Cartoon HD app to check and read the content on the SD card.

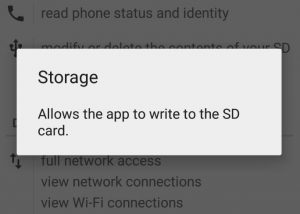

10 – There is no download option, which means there is no requirement for the Cartoon HD apk to write on the SD card but it is asking for additional permission, which is suspicious.

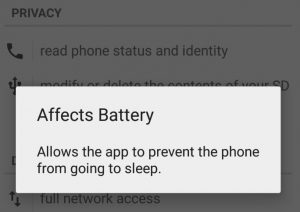

11 – As you can see that your battery will be affected because it does not let the phone to go to sleep.

12 – If you agree with all of the permission the cartoon android is asking for, then you can tap the Install button. The installation of the app will begin.

13 – The installation process takes more than one minute to complete. The installation speed depends on your smartphone configuration, so you may have to wait few more minutes to get cartoon hd apk installed.

But in the end, it will be installed. In case, if there is an error, then repeat the process.

In many situations apps that have an installation error are corrupted, so we recommend you download the one we provide because we have tested these apps on our smartphones before suggesting you on the platform.

Cartoon HD Download For iOS / iPhone

Many of you are looking for a Download cartoon HD apk for iPhone/iOS. It does not matter if you have an iOS device like an iPhone or an iPad because the Cartoon HD app is available for iOS devices as well.

However, they are not stable, and they may crash on your smartphone countless times, which will leave you no choice but to switch to another service.

The Installation process will remain the same because none of these apps is available on the official site.

You can download the iOS version app but it is not stable, and you will face crashes and laggy experience from the service. The developers of the apps have not answered and fixed the issue to this date.

First, after downloading the APK file from the link provided, go to the Settings and scroll down to the Security section where you’ll need to enable installing apps from Unknown Sources.

Next, navigate back to the APK file folder, open the APK file, and click on install. This is it, now you just need to open the app and you are all set to enjoy the streaming of the favorite cartoon shows.

Next up is iOS, also for which you don’t need to jailbreak your device. But sadly, few of the iOS versions do not support this method. All in all, you can give it a try.

Firstly, you need to set the date on your iOS device to 1st August 2014. For that, just go to the Settings / General Settings / Date & Time and change the date. (You don’t have to change the time).

Now, open the Safari browser and download the Cartoon HD file from here. Now, open the file and press Install. The first time you open the app, you will receive an Untrusted App Developer push request, just press on Trust and you’re all set to go and enjoy HD Cartoons, Movies, and TV Series for free.

Now you can set back the date to automatic. If you are receiving the “Unable to Download App – “Cartoon HD” could not be installed at this time.” error message, this means that your iOS version doesn’t support and you will need to jailbreak your iOS device.

You can Jailbreak your iOS device from the tutorials online. After finishing it, just open Cydia and go to the Sources tab. Press on edit, then press Add and add the below URL.

http://cydia.dtathemes.com/repo

Press on Done and open the themes Repo. Then press dta-apps and go to Cartoon HD V2. Now press install and then press Confirm.

Once the installation is complete, the app is available to stream a variety of cartoons, anime, movies, and TV series in HD.

For the BlackBerry users

Firstly download the Cartoon HD file from the link given on your BlackBerry 10 phone or Tablet. This process works for the BlackBerry devices running OS version 10.2 or higher, including the Z10, Z30, Q5, Q10, 9982, 9983, Passport, and later.

Now, go to the Settings / App Manager / Install Apps and enable Installing apps from other sources.

Now go back to the downloaded file on your device, open it, and install Cartoon HD. And that is it, you are now set to enjoy the Cartoon HD services.

For the Kindle Fire users

You will also have to install the app through a sideloading process. To install, you don’t need any kind of root access. It’s a simple process it will work for all Kindle Versions. Fire tablet or phone including the 1st gen, HD, HDX, Fire tablets, and the Amazon Fire Phone.

First, you will have to download the Cartoon HD app file from the link provided. Then, on your Kindle Fire or Kindle Fire HD device, go to the Settings / Devices / and enable Installation of Apps from Unknown Sources

For the Kindle Fire HDX, Fire Tablet, and Amazon Fire Phone go to Settings / Security / and enable Apps from unknown sources.

Once the above process is done, navigate back to the downloaded file, open it, and click on Install. That is it, you are now all set to use the app.

The Cartoon HD App is one of the universal apps available for all platforms. Other than that, you have many other alternatives such as Mobdro and Popcorn Time to stream your favorite movies and TV series.

Yes, I want to add one more thing this cartoon hd apk for iPhone is the truly amazing and nice way to give all latest episode of the cartoon hd apk mod.

But we hope that they are working on it.

How to Download Cartoon HD Videos?

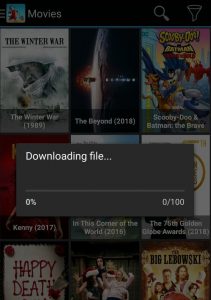

Step 1: Tap on the app icon

Step 2: After the main interface, you will be able to see various trending videos and other movies. On the top right side of the app, there’s a funnel and a search symbol.

Step 3: For filtering what you want to watch, click on the funnel icon on the top right side of the Cartoon HD app.

Step 4: After tapping on the funnel symbol, you will see a number of options on the menu. The popular videos, IMDB reviews of the movie, best tending, genres of movies, and much more will be visible.

Step 5: Simply tap an option on the menu like “Popular Movies” on the Cartoon HD App

Step 6: Select your choice of the movie from the listed ones. A movie related information will appear in the next dialogue box along with a short description of IMDB ratings, content, and much more.

Step 7: Next to the “info” button, tap on the “video” option.

Step 8: Select your favorite video you would like to watch with the resolution you want on the next dialogue box.

Step 9: Simply click on the “Download” button

Why is Cartoon HD APK Not Available on Google Play?

If we think about the number of apps present in the play store are vast.

However, did you know that as a creator of an application there are several rules and policies of Google, which we have to face?

Every Android freeware on the play store goes through a security check, and the creators have to pay a huge price if they are breaking the rules or the policies.

Distribution of the cartoon with proper licensing from the makers violates copyright infringement.

When you are broadcasting it online, you must get the necessary rights as Netflix does; they buy the rights, then the content is available on the platform.

By now you must have realized that it is not possible for the developers to pass the policy because it is against Google policies and the law to stream such content online with permission from the makers.

Coming to Apple iTunes, the same reason applies to them as well. If you look at the iTunes policies, they are pure entertainment library, where you are not allowed to sell or distribute anything without proper copyrights.

How to Cartoon-HD Video Download for PC?

If you are planning to download the videos and episodes of a series on your laptop or PC, then it is not possible because the services do not have any official option.

Not many of you know that there are third-party apps on the play store, which allows you to download videos and movies streamed on other apps.

If you are planning to learn how you can download the videos from the app, then you can Google it, but there is no official method to do so.

My Cartoon-HD-Apk Review

We have said earlier that we test the app ourselves before we suggest you download it.

I really enjoy this app after download this cartoon HD app I really enjoy watching a cartoon in my free time and feel free in my mind so this is the most recommended app you can also enjoy your free time with this cartoon HD app.

One more benefit of this apk is that not take the load on your smartphone or desktop device it will run smoothly and also ask for an update whenever the publisher updates the cartoon HD app.

What do we think about the app services? Here is the review you are waiting for it.

Number one – The number of permissions asked by the app is suspicious, which is a flag that there is something wrong with the featured utility.

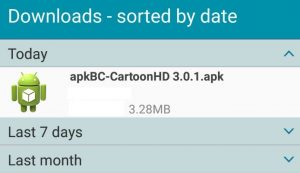

Number two – The file size of the app is only 3.3MB, where there is no way that an entertainment-based app can come under 3MB. The least megabyte that has developed the entertainment app is Netflix, which is less than 40MB.

Number Three – After we have installed it on your smartphone, we have launched it to check its content. As we have suspected, some pop-ups lead to a website called “Fofy,” which is an entertainment informational based site.

Number four – It is completely fine if the service is trying to make money from the pop-up advertisements, which is part of many monetization methods. But, the Cartoon HD app is downloading unknown files without our permission.

There is no option to stop it, which means we have to just look at it until the download finished.

In the above tutorial, we have told you to let the “unknown sources” enabled for this installation only, then untick it, right? As you can see from the image above the Cartoon HD is trying to install a random app, which is not right.

officially play store has removed Cartoon HD App from the play store but here we are sharing a method that how you can get still download your favorite app without the play store

We have uninstalled the app. so enjoy your app today and download free cartoons with the use of this cartoon HD app & enjoy in your free time.

Features of CartoonHD

As I have discussed above that cartoon HD Apk allows you to watch all your favorite cartoon movies for free and helps you to live your childhood memories once again with this application.

Here I am going to list down some highlighted features of cartoon HD Apk which will help you to enhance your experience with this application.

Cartoon HD APK has a powerful graphical user interface that is appropriately arranged with a great understanding considering the requirements of users.

The latest and the newer update of the Cartoon HD APK allows you to enjoy 3D movies as well.

- This app has been made for every generation so that you will get to watch different genres of cartoon movies, TV shows from old to the latest released ones.

- It provides you high-quality video resolution without any interruptions such as buffering.

- Download it from the link given above and you will be able to use it completely free, you would not have to pay a single penny to use it.

- It has a very simple user interface, to use it simply you just have to download and install it on your device like other applications.

- It gives you an option to choose video quality which ranges from 360p to 720p.

- Provide you the feature of downloading videos so that in case if you don’t have an internet connection then also you can watch videos. You just have to make sure that you downloaded the video.

- Keeps you updated with all the latest movies and TV shows.

- While playing videos don’t worry about security issues because it has a high level of security protection.

- So, these are some amazing features of cartoon HD Apk, hope you liked it.

Conclusion

We do not recommend you to download and install Cartoon HD because it does not provide any cartoon series. Instead of that, they are making money off it and installing anonymous applications through the app.

Let us know what do you think about it in the comment section feel free to update the comment below in the comment section.

Frequently Asked Questions (FAQs) – Cartoon HD app

This application can have very good quality content.

No, Cartoon HD doesn’t have any video on their server they simply get top-notch joins from the web.

Truly! You can download and watch online any motion pictures from the Cartoon HD App. For downloading the motion pictures from this application, it requires tapping on the “Recordings” tab play the video and afterward tap on the download symbol there.

All things considered, the response to this inquiry not excessively much direct but rather in the event that you are soliciting in light of the fact that from any legitimate activity against it, at that point don’t stress the sole duty is going to application engineers. You won’t fall into any difficulty since it has practically 50millions clients who introduced the Apk on Android and different gadgets.

On the off chance that you are downloading Cartoon HD Apk from the obscure source, at that point be careful; your gadget may be tainted with the infection. So ensure you are downloading the Apk document from a confided in a source, and even I prescribe you to filter the apk with a decent antivirus. All out Virus is best online too that output all kinds of archives with various antivirus devices at the same time, so filter it first and afterward introduce. The APK record given here is totally tried and safe to utilize.

The response to this inquiry is YES! We can introduce Cartoon HD Apk on Blackberry gadgets as well. Actually, the establishment procedure is practically like Android gadgets. We have a different itemized article on this with the total establishment process for Blackberry and different gadgets like Amazon FireTV, Kodi Smart TV, and Roku gadgets.

Is Cartoon HD banned; this the most significant inquiry posed about Cartoon HD, yet authorities guarantee that they scrap recordings from various facilitated places that don’t violate any law yet at the same time clients won’t stumble into any official difficulty. In the event that anything occurs; the sole obligation goes to designers of Cartoon HD App.

Truly, Cartoon HD Apk is totally allowed to utilize and gives premium substance like – films, TV arrangement, and cartoons for nothing. This is the sole motivation behind why the application has picked up so much ubiquity and is viewed as the #1 application with the expectation of complimentary premium substance (motion pictures, shows, and cartoons). Dissimilar to Netflix and Amazon Prime Videos, you need not in any case register on Cartoon HD so as to stream or download motion pictures and TV appears.

Truly, it is 100% safe to stream motion pictures, TV programs and cartoons on Cartoon HD App. The site gives content that is free from spyware, malware, infections and different noxious substance that may hurt your framework. Indeed, clients can even download motion pictures and show utilizing this application effectively and with no issue (free from infections, obviously).

In spite of the fact that this may sound conflicting to many, Cartoon HD App isn’t at all illicit. It is a straightforward electronic help that gives free video substance to a huge number of clients around the world. The sole explanation that it is being utilized by millions today and to date, no one related to the application/administration has confronted any legitimate issue tells us that it isn’t unlawful to utilize. Individuals should utilize the application admirably and sufficiently.

The establishment of the Cartoon HD App changes from the working framework to the working framework. Since it is diverse for each working framework, an appropriate guidance guide can be found for the different working framework from the resulting headings.

Not in the least. Cartoon HD App has been created by a gathering of ostentatious engineers and coders that have ensured that the clients get an impeccable and extravagant experience while utilizing the application. The application utilizes a progressive, Cloud Acceleration Technology alongside Advanced Video Encoding innovation. The previous makes the video substance load quicker from the server while the last one makes the recordings run easily, without expending a lot of intensity and battery life (if utilizing on a convenient gadget). Along these lines, it is protected to state that the Cartoon HD App doesn’t make your gadget slower.

Shockingly, yes you can! Cartoon HD doesn’t require an extremely quick web association so as to run (not at all like Netflix and HBO Go). All you need is a basic 100 Kb/s or more association (3G or more speeds) and you are a great idea to go. You can either stream the recordings on the web or can even download it on your gadget and watch them later. You additionally don’t need to stress over the nature of the substance since Cartoon HD ensures that you get the best accessible video available to you.

Recent Comments